In any economy that comprises several markets with numerous transactions, there are four major driving forces i.e. productivity growth, short term debt cycle, long term debt cycle, and politics. Productivity growth is a long term process led by hard work and innovation. The debt cycles are the result of an influx of credit into the economy. In this regard, short-term debt cycle lasts for about 10 years whereas long-term debt cycle happens once every 50-75 years leading to a change in the financial and monetary system. Politics means how countries deal with each other and their people regarding various internal and external issues. These forces on their own create several varieties of economic movements and subsequent trends creating one whole stable economic system. However, the recent COVID-19 outbreak, with its widespread impact on the economy, led to disruptions on these driving forces of the economy.

Many economists had predicted the current recession before the outbreak of this virus; Neil Irwin, senior economics correspondent for The New York Times, even mentioned the global recession happening in 2020 in his article “How the Recession of 2020 Could Happen” (written on August 17, 2019). Also, economists widely believe that this pandemic has just sped-up the process and has put the current global economy in a never seen situation as the economic activities have fallen to historically low levels due to travel restrictions, disruption in the supply chain and restricted lifestyle as a precaution against this pandemic which has temporarily frozen the global economy.

While the financial crisis of 2008 was something that took its time to develop into something severe, the financial crisis that we are going to be facing now shall be worse since it will be affecting multiple aspects of the economy from consumption to investment, production, retail sales, and capital expenditure. This is in contrast to the previous crisis of 2008 and even the Great Depression that took the time of about 1-2 years to gradually unravel to a worse situation. This time around, things are going to unravel suddenly without providing much of response time or even options due to the multidimensional impact of the closure of the economies all around the world.

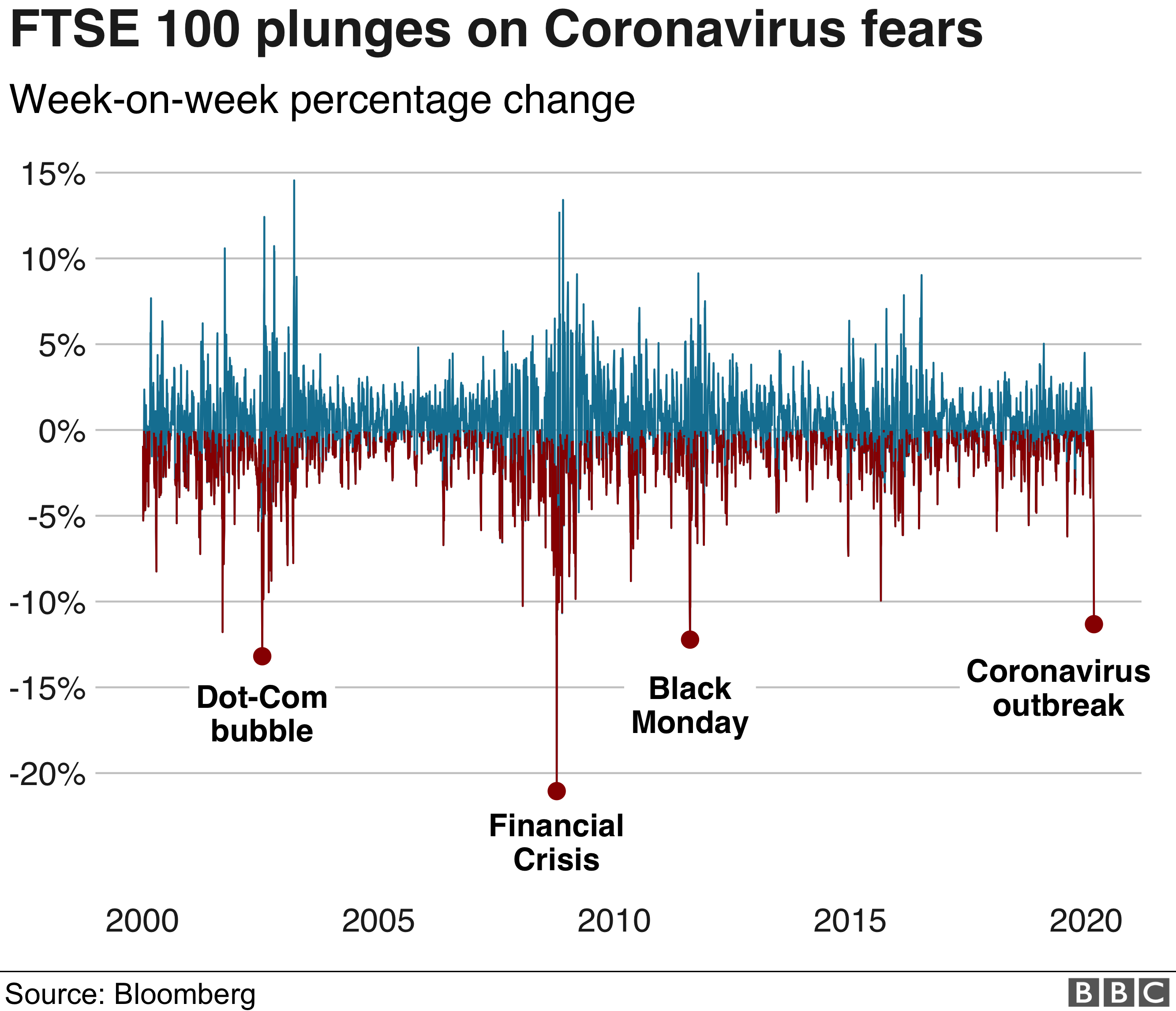

Investors were already worried when President Donald Trump tossed trade wars with China. Many economists predicted the global recession due to advanced technologies killing many jobs, increase in borrowing and the trade war between China and US; the most discussed matter. However, the major cause of this recession being pandemic was the massive blow to the investors and the entire world. The major aspect of this crisis shall be that it will not just impact one economy or two or just affect the big economies and spare the smaller ones. The global lockdown shall affect each and every economy of the world in an independent as well as interconnected manner. Economists predict that we will most probably face a severe global recession in the first three quarters of 2020 which might even take more than three quarters for recovery. JP Morgan claims that this outbreak shall contract the global economy by 12% within the first 3 months of 2020. This is further aggravated by the 60% slump in oil prices. Many countries and experts have already announced the current economic situation as the global recession. The USA stock market has already seen the largest single-day point decline. The largest decline while “the dot-com bubble” was 49% but it took 2 years to reach there. This time, the scenario is very different as the S&P 500 index (stock index of 500 large companies) saw its largest one week decline of 36% since the financial crash of 2008.

As the outbreak started in China, the first economic impact it made was the fall in Chinese exports. With China being the top exporter in the world, the downfall of exports from China due to the pandemic directly impacted its trading partners that include economies like the USA, Japan, South Korea, Germany, and India. As the overseas demand sores due to spread of the virus in major importers, the running capacity of factories has decreased by more than 50%. To fight this, the Chinese economy started to run the factories and business after 6 weeks of shutdown but still millions of migrant workers have not been able to return to their job due to fear of getting infected. Thus, due to the break in the supply chain China, like the rest of the world, might not be able to make a quick recovery from an economic standpoint even if it recovers from the virus successfully.

With travel restrictions in over 100 countries, the airline industry has faced a massive drop in the number of commercial flights per day. According to Airlines for America, at the beginning of 2020, about 111 thousand commercial flights were being operated while the most recent week shows the drop of the daily commercial flights to 31 thousand due to the COVID-19 outbreak. .In regards to the hospitality industry, there has been a sharp decline in the hotel occupancy rate globally as compared to 2019 figures. Countries like Italy, China, United Kingdom, United States, and Singapore have observed decline in the occupancy by 96%, 68%, 67%, 59%, and 48% respectively. Also, due to the less occupancy rate, hotels are forced to accept lower prices during this time. This has caused fall in the RevPAR (Revenue Per Available Room) in a way that is worse than it had been during the September 11 terror attacks and financial crisis of 2008.

In terms of the oil industry, the decline in production of oil due to less consumption has collapsed the per barrel price of oil in the last four months from rising $64.58 (on January 5) to $20 (on April 1). Iran is affected largely by the collapse of oil prices as economists are estimating this impact to shrink Iran’s GDP by a third and create at least a $10 billion budget deficit in 2020; the economy of Iran was already tangling due to US’s trade sanction and the pandemic has made the situation even more sensitive. Besides Iran, Saudi Arabia (the largest exporter of petroleum) is also massively affected by this pandemic as oil prices have been decreasing and the supply will decrease by million barrels since the global storage tanks are already beginning to fill up. Another hard-hit sector in the manufacturing industry is auto production as the global auto product is estimated to decrease by 16% (1.4 million vehicles).

As the pandemic continues to progress from nation to nation, many companies including bigger businesses are getting to the brink of bankruptcy. With travel restrictions and closure of economies, businesses are already struggling to cover their fixed costs. The impact of this is immediately seen in the hospitality and aviation industry. Consequently, businesses are forced to layoff employees or grant furlough. The pressure is even more for start-ups. As mass joblessness has already started to take place, more than 16 million Americans have already claimed for unemployment benefits in just two weeks. To decrease unemployment, the French government is trying to protect as many companies as possible by sheltering every worker. In response, the government has allocated €45 billion as employment protection and €300 billion as state-guaranteed loans; the idea of no layoffs which the French government claims as a lesson learned from the crash of 2008. A similar approach has been applied by Germany, Austria, Denmark, and Britain to provide employers with short-time work and furlough in many cases.

Post this global health crisis, it is obvious that there will be a great increase in government borrowing from many smaller as well as bigger economies. While the global economy had already been facing the challenge of ever-increasing debt as compared to the global GDP, the most anticipated debt crisis has now become imminent. As the economic impact of the virus is severe especially in poor countries. Countries like Iran whose economy is largely dependent on oil, the only option to save the economy is to start borrowing and the Iranian government has already requested $5 billion loans from IMF; EU and Japan have donated a few millions as humanitarian aid to Iran. However, the fatality of the virus has been severe mostly in developed nations like Italy, Spain and the USA. The next great impact of the virus is assumed to be in the US as the number of infected has already crossed 500,000. Like Iran, other developing and struggling developed countries (Italy and Spain) will also be desperate to borrow money to recover their economies.

According to Institute of International Finance, the global debt at the end of September 2019 surged to $253 trillion which is a lot given the total economic output of the entire world is $84 trillion (3 times less). Post the pandemic, the global debt is expected to further increase. This has resulted in a situation where even stronger economies like the US, European Union, China or Japan, and international financial organizations will hesitate or delay providing loans to developing countries who will be heavily in need of relief funds. However, there will be massive borrowing to fight this recession. While the coronavirus has forced the whole world to halt, the impact of the virus, which has not even exceeded a month, will definitely go beyond the death tolls and infection rate creating a significant and long-lasting impact on the global economy.

Written by:

Rushma Gadtaula and Kushal Achhami

Reblogged this on Little Nothings and commented:

The impact of the virus will definitely go beyond the death tolls and infection rate creating a significant and long-lasting impact on the global economy.

LikeLike